Summary of the article:

The article discusses the analysis and trading strategies for the SPDR S&P Biotech ETF ($XBI) using various technical indicators, including VantagePoint’s A.I. forecast (predictive blue line), neural network indicator (machine learning), and intermarket analysis.

Key points:

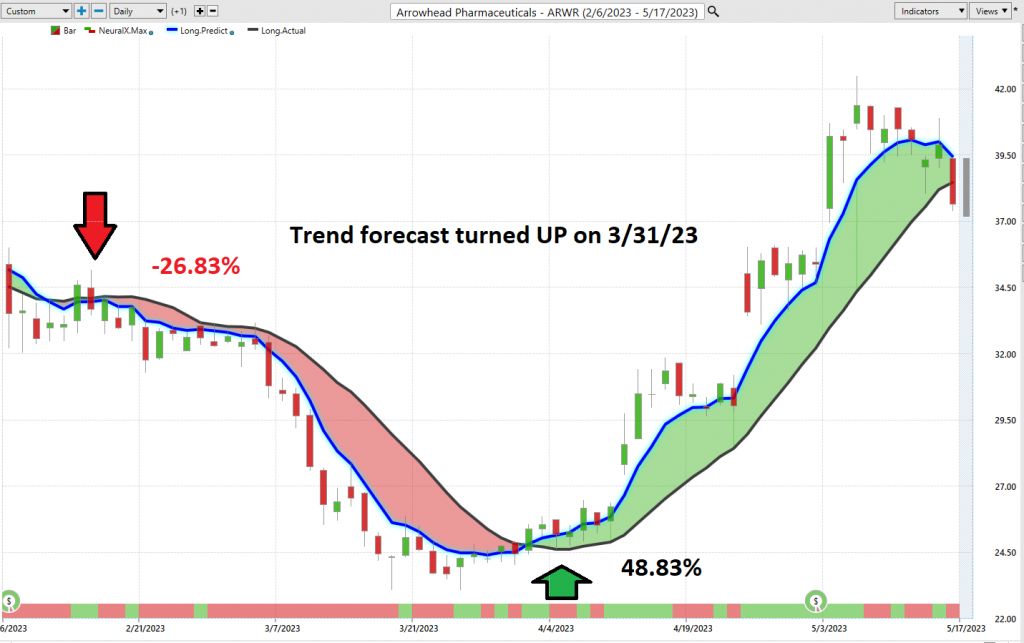

- VantagePoint A.I. Forecast (Predictive Blue Line): This tool uses artificial intelligence and statistical correlations to predict the medium-term trend price forecast of $XBI.

- Neural Network Indicator (Machine Learning): The neural network indicator is a reliable tool for predicting the near-term strength or weakness in the market, providing valuable insights for traders.

- Intermarket Analysis: This analytical approach enables traders to examine statistical price correlations across various asset classes, helping them anticipate price movements more effectively.

- Trading Strategy: The article suggests following the A.I. trend analysis as outlined in the stock study and practicing good money management on all trades.

The article also emphasizes the importance of intermarket analysis in identifying key price drivers of an asset, which can help traders make informed decision-making.

Risk Warning:

- There is a high degree of risk involved in trading.

- It’s not prudent or advisable to make trading decisions that are beyond your financial means or involve trading capital that you’re not willing and capable of losing.

- VantagePoint’s marketing campaigns do not constitute trading advice or an endorsement/recommendation by VantagePoint AI or any associated affiliates of any trading methods, programs, systems, or routines.

Conclusion:

The article provides a comprehensive analysis of the $XBI using various technical indicators. Traders can use this information to make informed decisions and develop strategies for trading $XBI. However, it’s essential to remember that trading involves risk, and traders should always prioritize good money management and be aware of their financial limitations.

Recommendations:

- Follow the A.I. trend analysis: Use the VantagePoint A.I. forecast (predictive blue line) and neural network indicator to make informed trading decisions.

- Practice good money management: Manage your risk exposure, set stop-loss orders, and adjust your position sizes accordingly.

- Stay up-to-date with market developments: Continuously monitor the markets and adjust your strategies as needed.

By following these recommendations, traders can potentially increase their chances of success in trading $XBI.

Disclaimer:

The information provided is for educational purposes only and should not be considered as investment advice or a solicitation to buy or sell any securities. Trading involves risk, and it’s essential to understand the risks involved before making any investment decisions.

Final Thoughts:

Trading requires discipline, patience, and continuous learning. By staying informed about market developments and using technical indicators effectively, traders can make more informed decision-making. However, always remember that there is no magic formula for success in trading. Machine learning and artificial intelligence can provide valuable insights, but they should be used in conjunction with good money management and risk control strategies.

Additional Resources:

- VantagePoint Software: www.vantagepointsoftware.com

- Intermarket Analysis: www.investopedia.com/terms/i/intermarket-analysis.asp

- Machine Learning in Trading: www.tradersdna.com/machine-learning-in-trading/