In-Depth Analysis of PNC Financial Services Group Stock: A Breakdown of the Pre-Trade Analysis, Entry, and Exit Strategies

The stock market can be a complex and unforgiving place, with even the most seasoned traders facing unexpected twists and turns. However, by carefully analyzing each opportunity, traders can make informed decisions and minimize their risk exposure. In this article, we will take an in-depth look at the PNC Financial Services Group (PNC) stock, exploring its pre-trade analysis, entry strategies, and exit points to gain a deeper understanding of how power traders use artificial intelligence to navigate the market.

Pre-Trade Analysis: Understanding the Fundamentals of PNC

The first step in any trading or investing strategy is to conduct thorough research on the underlying asset. In the case of PNC, we have 18 analysts offering 12-month price forecasts, with a median target of $160.50 and a high estimate of $179.00. While this may seem like a relatively optimistic outlook, it’s essential to consider the broader market trends and the economic climate.

PNC: A Widely Covered Stock with Diverse Analyst Opinions

The widespread coverage of PNC by financial analysts and traders is a testament to its importance in the banking sector. However, the diverse opinions on the stock’s future performance create an opportunity for traders to capitalize on potential mispricing. With a trading range of 83.34 over the past year, PNC has averaged 2.3 million shares per day, making it a liquid asset with significant volume.

Common Sense Metrics: Understanding the Trading Range

When analyzing any stock, it’s crucial to consider its historical price movements and trading ranges. For PNC, we can see that its trading range over the past year equates to an average weekly trading range of 1.60. This provides a benchmark for short-term trades, allowing traders to amplify their metrics and adapt to changing market conditions.

Banks: A Hit-or-Miss Sector in the Current Economic Climate

The banking sector is notoriously volatile, with interest rate environments and economic lockdowns creating uncertainty. However, PNC’s $443 billion in assets makes it one of the largest banks in the country. Its decision to sell its $17 billion stake in BlackRock, the world’s largest asset management firm, marked a significant shift in the company’s strategy.

Entry: Identifying Opportunities with Artificial Intelligence

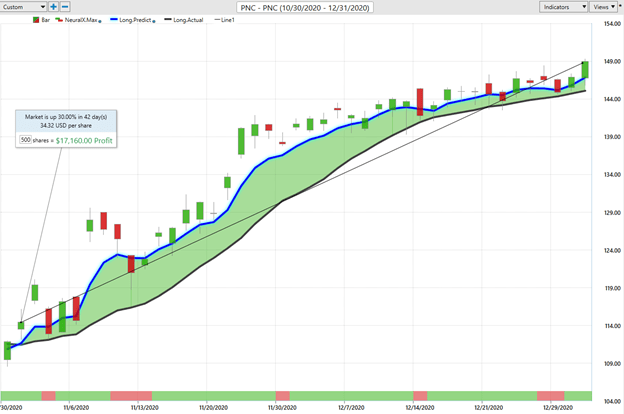

The entry point for any trade is critical, and PNC has provided several opportunities for power traders. In November 2020, Vantagepoint Intelliscan users were alerted to a trend forecast change from DOWN to UP by the artificial intelligence system. This was indicated by the predictive blue line moving above price, creating a "value zone" where traders could purchase PNC at or below.

Monitoring the Predictive Blue Line and Neural Network Indicator

Power traders use the predictive blue line as a guide for determining both value zones and trend directions. The neural network indicator, which predicts future strength and/or weakness in the market, also plays a crucial role in identifying optimal entry and exit points. By monitoring these indicators, traders can adjust their strategies to respond to changing market conditions.

The Swing Trade Holding Period: Amplifying Gains with Artificial Intelligence

Over the past two months, PNC rallied from 115 to 149.31, providing a significant trading opportunity for power traders. The stock price consistently stayed above the predictive blue line, resulting in a 30% rally over 42 days. This example highlights the importance of using artificial intelligence to amplify gains and minimize losses.

The Exit: Recognizing Trend Reversals with Artificial Intelligence

Recognizing trend reversals is essential for successful trading, and PNC has provided several examples of this. When the predictive blue line turns lower and closes below the black line, accompanied by a weak close below the previous day’s low, it often indicates a powerful forecast of future weakness in the market.

Conclusion: The Importance of Artificial Intelligence in Trading

The analysis of PNC Financial Services Group stock demonstrates the critical role that artificial intelligence plays in trading. By using advanced predictive models and indicators, power traders can navigate the complexities of the market and make informed decisions. As we continue to monitor PNC for future trading opportunities, it’s essential to remember that even the most seasoned traders face unexpected twists and turns.

In-Depth Analysis of Intermarket Analysis

Intermarket analysis provides a comprehensive view of the factors driving price movements in various assets. In the case of PNC, this graphic highlights the ETFs, mutual funds, commodities, and stocks that are most closely correlated to its price action. This interconnectedness of prices is crucial for traders seeking to capitalize on potential mispricing.

Understanding Key Drivers of Price Action

The drivers of price movements in PNC can be complex and multifaceted. Interest rates, crude oil prices, and volatility in the dollar all contribute to the company’s performance. By studying these factors and their statistical correlations, power traders can gain a deeper understanding of the underlying dynamics driving the market.

A Final Word: Caution and Prudence

Trading involves risk, and it’s essential for traders to be aware of their limitations and avoid making decisions that exceed their financial means or capabilities. Vantagepoint’s marketing campaigns are designed to educate and inform, but they do not constitute trading advice or an endorsement of any specific strategy or system.

Disclaimer: Risk Warning

There is a high degree of risk involved in trading, and it’s not prudent or advisable to make trading decisions that are beyond your financial means or involve trading capital that you are not willing and capable of losing. Vantagepoint’s marketing campaigns do not constitute trading advice or an endorsement or recommendation by Vantagepoint AI or any associated affiliates of any trading methods, programs, systems, or routines.

Conclusion: Embracing the Power of Artificial Intelligence in Trading

The analysis of PNC Financial Services Group stock demonstrates the power and potential of artificial intelligence in trading. By leveraging advanced predictive models and indicators, traders can navigate the complexities of the market and make informed decisions. As we continue to monitor PNC for future trading opportunities, it’s essential to remember that even the most seasoned traders face unexpected twists and turns.

Disclaimer: Risk Warning

There is a high degree of risk involved in trading, and it’s not prudent or advisable to make trading decisions that are beyond your financial means or involve trading capital that you are not willing and capable of losing. Vantagepoint’s marketing campaigns do not constitute trading advice or an endorsement or recommendation by Vantagepoint AI or any associated affiliates of any trading methods, programs, systems, or routines.

Let’s Be Careful Out There!

It’s essential for traders to be aware of their limitations and avoid making decisions that exceed their financial means or capabilities. By being cautious and prudent, traders can minimize their risk exposure and maximize their potential gains in the market.