This text is a comprehensive analysis of Uranium Energy Corp. (UEC) stock, using various technical and fundamental indicators to make a trading recommendation.

Key Findings:

- Strong Earnings Growth: UEC has posted an impressive average annual earnings growth of 36.7%, outpacing the broader Oil and Gas sector.

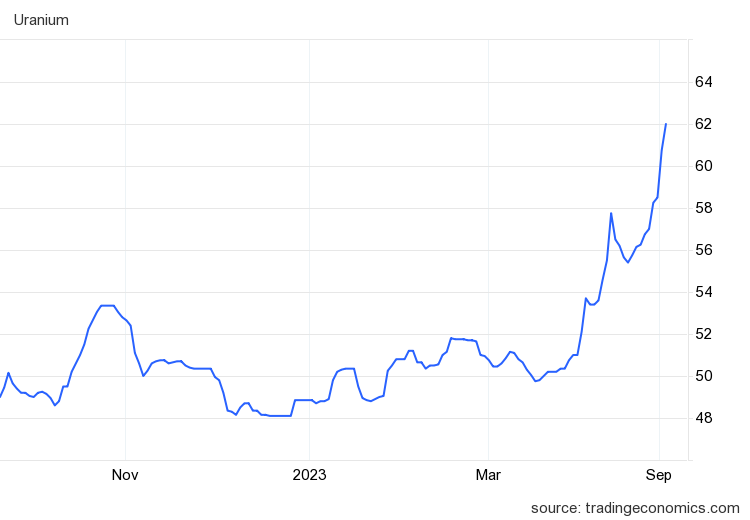

- Supply-Demand Imbalance: The company’s performance over the past year has been stellar due to a supply/demand imbalance, leading to exponential increases in uranium prices.

- Structural Supply Imbalance: The market is set up to move substantially higher due to the structural supply imbalance, with current deficits on this basic strategic commodity and energy staple.

Technical Indicators:

- Predictive Blue Line: The Predictive Blue Line forecast suggests an upward trend in UEC’s price.

- Neural Index: The Neural Index is also showing a bullish signal, indicating that the market is likely to continue moving upwards.

- Daily Range Forecast: VantagePoint’s Daily Range Forecast suggests potential trading opportunities based on the predicted high and low points.

Recommendation:

- Long Position: The author recommends following the A.I. trend analysis outlined in this stock study and practicing good money management on all trades.

- Short-Term Swing Trading Opportunities: The author will continue to explore the long side of the market for short-term swing trading opportunities.

Disclaimer:

The author emphasizes that there is a high degree of risk involved in trading, and it’s not prudent or advisable to make trading decisions that are beyond one’s financial means or involve trading capital that cannot be lost. VantagePoint’s marketing campaigns do not constitute trading advice or an endorsement or recommendation by VantagePoint AI or any associated affiliates of any trading methods, programs, systems, or routines.

Overall, this analysis provides a comprehensive overview of UEC’s fundamentals and technical indicators, making a strong case for a long position in the stock.