MATANA Stocks: The New Bellwether Indicators of Market Trends

The stock market is a complex and ever-changing beast, with new acronyms and trading terminology emerging all the time. One term that has been making waves in recent months is "MATANA," which refers to six tech stocks that are being hailed as the new bellwethers of the market. In this article, we’ll delve into what MATANA means, why it’s so important, and how you can use these stocks to inform your trading decisions.

The Rise and Fall of FAANG

Before we dive into MATANA, let’s take a look at its predecessor: FAANG. This acronym stood for Facebook, Amazon, Apple, Netflix, and Google (now Alphabet), and was coined by Jim Cramer in 2013 as a way to describe the hottest tech stocks on the market. Over time, FAANG became synonymous with success, with these companies growing into some of the most valuable in the world.

However, in recent years, Facebook and Netflix have struggled, with their stock prices tumbling down. Facebook’s focus on creating Metaverse infrastructure has led to disappointing earnings, while Netflix has faced increased competition from Hulu and Amazon Prime Video. As a result, FAANG is no longer the go-to acronym for traders looking for insight into market trends.

Introducing MATANA: The New Bellwether Stocks

In response to the decline of FAANG, some analysts have proposed replacing Facebook and Netflix with two new stocks: NVIDIA and Microsoft. These six companies – Apple, Amazon, Alphabet (Google), Tesla, Microsoft, and NVIDIA – make up the "MATANA" acronym, which is being touted as the new benchmark for market performance.

What Makes MATANA So Special?

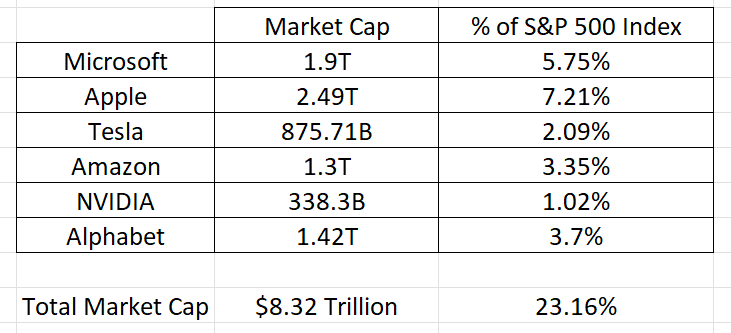

So what sets MATANA apart from FAANG? For one thing, these stocks are much larger in terms of market capitalization. Together, they represent 23.16% of the S&P 500 Index and have a combined value of over $8 trillion. As such, their performance is often seen as a good gauge of overall economic conditions.

Furthermore, MATANA stocks have historically outperformed the S&P 500 Index, making them an attractive option for traders looking to stay ahead of the curve. And with their diverse customer bases and innovative business models, it’s no wonder that these companies are being watched closely by investors and analysts alike.

How Can You Use MATANA in Your Trading Decisions?

So how can you use MATANA to inform your trading decisions? For one thing, monitoring these stocks can give you valuable insights into market trends. When they rally, chances are that the broader market will follow suit – and vice versa. By keeping an eye on MATANA, you can stay ahead of the curve and make more informed buying and selling decisions.

But how exactly do you use MATANA? One way is to look at the charts above, which show the recent performance of each stock. You can see that all six stocks have fallen recently, with some dropping by as much as 24%. While this may seem like bad news, it’s actually a sign that traders are taking their cues from these bellwether stocks.

The Vantagepoint A.I. Forecast: A Powerful Tool for Traders

As you can see from the charts above, the Vantagepoint A.I. Forecast (Predictive Blue Line) has been providing valuable insights into market trends. By using this tool in conjunction with other performance benchmarks – such as Wall Street Analysts’ Estimates, 52-week high and low boundaries, and Neural Network Forecast – traders can get a more complete picture of what’s happening in the markets.

But be careful: the Vantagepoint A.I. Forecast is not a substitute for human judgment or critical thinking. It’s simply one tool among many that can help you make informed trading decisions.

Conclusion

In conclusion, MATANA stocks are the new bellwether indicators of market trends. By monitoring these six companies – Apple, Amazon, Alphabet (Google), Tesla, Microsoft, and NVIDIA – traders can gain valuable insights into overall economic conditions. While FAANG may be out of favor, MATANA is here to stay – and with its powerful combination of market capitalization and historical performance, it’s an acronym that traders will be watching closely for years to come.

Remember, trading involves risk – so always do your own research and never invest more than you can afford to lose.