This is a comprehensive stock analysis report for Tesla (TSLA) using various technical and fundamental indicators. Here’s a summary of the key points:

Overview

- The report provides an in-depth analysis of TSLA’s performance, trends, and potential opportunities for traders and investors.

- It uses advanced tools such as VantagePoint software, Neural Networks, and Intermarket Analysis to provide accurate and reliable predictions.

Trend and Forecast

- The current trend is UP, with a momentum indicator suggesting continued growth.

- The predictive blue line in the VantagePoint chart indicates an uptrend, which has been confirmed by two consecutive closes above the line.

- The Neural Network Indicator is green, indicating market strength and potential buying opportunities.

Short-Term Trading Opportunities

- The report suggests focusing on short-term swing trading opportunities, given the stock’s high volatility.

- Traders can look for buying opportunities towards the bottom of the predicted channel in the VantagePoint Daily Range Forecast.

Long-Term Outlook

- The report notes that TSLA faces numerous major challenges in 2023, including potential recessionary pressures.

- It advises traders to exercise caution and consider the risks before making a purchase decision.

Recommendation

- The report recommends following the A.I. trend analysis outlined in the study and practicing good money management on all trades.

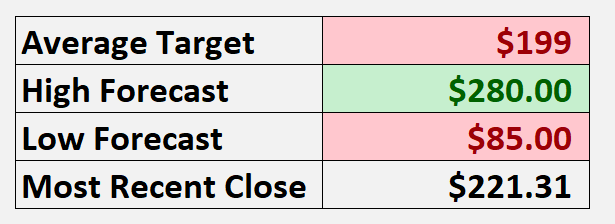

- Traders are advised to re-evaluate daily based on new Wall Street Analysts’ Estimates, 52-week high and low boundaries, VantagePoint A.I. Forecast, Neural Network Forecast, and Daily Range Forecast.

Disclaimer

- The report emphasizes that trading involves a high degree of risk and is not suitable for all investors.

- It advises readers to make informed decisions based on their own financial means and risk tolerance.

Overall, this report provides a detailed analysis of TSLA’s performance, trends, and potential opportunities for traders and investors. However, it also highlights the risks involved in trading and advises caution when making investment decisions.