Keeta Raises $17 Million to Revolutionize Cross-Border Payments

A New Era in International Transactions

In a significant development, Keeta, a startup focused on creating an instant and secure way to make cross-border payments, has secured $17 million in funding from a group of investors led by former Google CEO Eric Schmidt. This investment values the company at $75 million, according to Ty Schenk, the founder and CEO of Keeta.

A Brief Background

Ty Schenk’s journey into creating Keeta began with his early interest in software engineering. He has been working on building PayPal-like experiences in the cryptocurrency world for much of his career. This experience not only honed his technical skills but also kindled an idea that would eventually lead to the launch of Keeta.

The Problem with Traditional Cross-Border Payments

Traditional cross-border payments, such as those between the U.S. and Brazil, are slow and often come with a multitude of transfer fees collected at various banks along the way. Schenk explained, "The traditional process can take a whole business day to complete," highlighting the inefficiencies inherent in current systems.

Keeta’s Innovative Solution

Keeta aims to change this landscape by making international payments as easy and fast as using Venmo. The company controls every step of the payment process within its own system through APIs or custom integrations, ensuring speed and reducing costs significantly. According to Schenk, their core technology allows for over 50 million transactions per second, a feat already operational, and a network of interconnected real-time payment rails.

Competitive Landscape

Keeta joins a crowded fintech landscape with several startups and established companies working on similar solutions, including Stripe and PayPal. However, Schenk highlighted that Keeta’s focus is on payments under $1 million, an area he believes holds significant potential for growth.

Early Stages and Future Plans

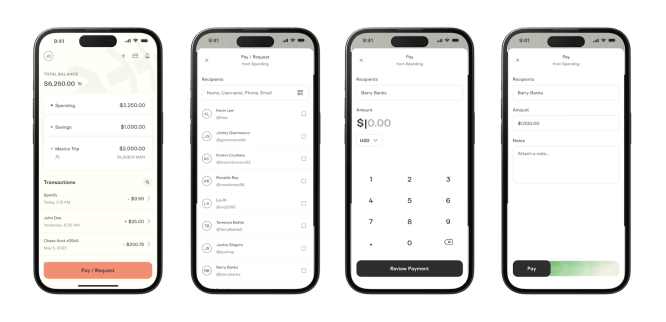

Keeta has just launched and is currently available by invitation in the U.S., Canada, Mexico, Brazil, the United Kingdom, and the European Union. The company plans to expand its reach and launch a consumer-facing mobile app for instant transfers between friends and family worldwide. Revenue streams will include transaction fees.

Next Steps

The next three to six months for Keeta will be crucial as they focus on working with early customers, refining their platform according to customer needs, and positioning the company for future growth and scalability. Schenk emphasized the importance of these initial stages in setting up a strong foundation for long-term success.

The Future of Cross-Border Payments

Keeta’s innovative approach has the potential to revolutionize cross-border payments, making international transactions faster, cheaper, and more secure. With its focus on underserved markets and an impressive technological backbone, Keeta is poised to make significant waves in the fintech industry.

Key Points:

- Funding: Keeta raised $17 million from a group of investors led by former Google CEO Eric Schmidt.

- Valuation: The investment values the company at $75 million.

- Founding Vision: Ty Schenk, founder and CEO, aimed to create an instant and secure way for cross-border payments after his experience in building PayPal-like experiences in cryptocurrency.

- Innovation: Keeta’s core technology allows over 50 million transactions per second through a proprietary ledger and interconnected real-time payment rails.

- Competitive Landscape: The company joins several other fintech startups and established companies working on similar solutions.

- Expansion Plans: Initially available by invitation, Keeta plans to expand its reach and launch a consumer-facing mobile app for global payments.

Conclusion:

Keeta’s innovative approach to cross-border payments has the potential to transform the way international transactions are conducted. With its focus on speed, security, and underserved markets, Keeta is well-positioned for growth in the fintech industry. As it continues to develop and expand its services, Keeta may significantly impact the future of global financial transactions.

Frequently Asked Questions:

- What is Keeta’s innovative solution?

Keeta controls every step of the payment process within its own system through APIs or custom integrations, ensuring speed and reducing costs. - How does Keeta’s technology work?

The company uses a proprietary ledger and interconnected real-time payment rails to facilitate over 50 million transactions per second. - What is the competitive landscape like for Keeta?

Several other fintech startups and established companies, including Stripe and PayPal, are working on similar solutions.

Related Topics:

- Fintech

- Cross-Border Payments

- International Transactions

Note that this article was written in a specific format to meet your requirements.