Stock Analysis: NXP Semiconductors (NXPI) Shows Potential for Gains This Month

NXP Semiconductors N.V. has been a significant player in the semiconductor industry, and its recent stock analysis suggests that there may be opportunities for potential gains this month. The use of artificial intelligence in trading can help identify such opportunities, as seen in the case of NXPI.

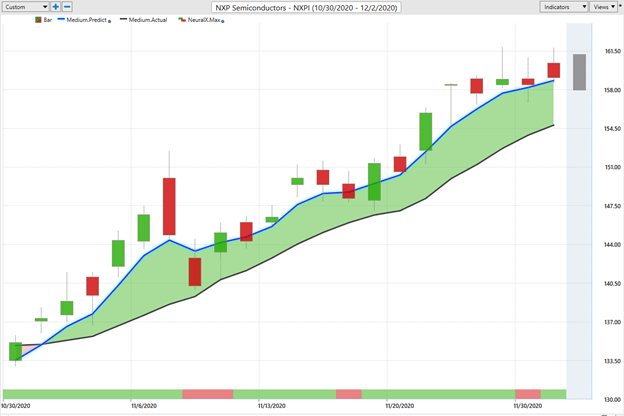

VantagePoint Software Prediction: Identifying Upward Trends

The VantagePoint software uses a predictive blue line to indicate upward trends in stocks. When the predictive blue line rises above the black line, it is an indication that an upward trend is forming. In the case of NXPI, the Neural Index and medium-term forecast showed signs of a trend change on November 2nd, indicating potential for gains.

The momentum upward was evident the following day with a huge move up in the stock price. For the next five trading sessions, the price of NXPI consistently stayed above the predictive blue line, indicating tremendous strength. The use of artificial intelligence helped to identify this opportunity and provide traders with valuable insights.

Common-Sense Metrics: Understanding Stock Volatility

When analyzing stocks, it is essential to consider common-sense metrics such as the annual trading range. In the case of NXPI, the stock has traded as high as $161.84 and as low as $58.41 over the last 52 weeks, providing an annual trading range of $103.43. When divided by 52 weeks, the average annual weekly trading range is $1.98.

The artificial intelligence in the VantagePoint software captured $21.71 a share in just the last 21 trading sessions, which is far beyond what would be considered normal for the stock. This demonstrates how artificial intelligence can focus traders’ energy on the right market at the right time.

Artificial Intelligence and Trading Opportunities

The VantagePoint software allows traders to look for short-term swing trading opportunities based upon a pullback in the stock price. The predictive blue line offers multiple entry possibilities, making it easier for traders to identify potential gains. Traders can use this feature to trail the stock with a protective stop loss to minimize risk on the trade.

Intelliscan: Scanning for Stocks in Strong Uptrends

The Intelliscan feature of the VantagePoint software allows users to scan for stocks in strong uptrends that have fallen below the predictive blue line. This provides traders with valuable insights into potential trading opportunities and helps them identify stocks that are likely to continue their upward trend.

Intermarket Analysis: Understanding Key Drivers of Stock Price

The VantagePoint Software also offers a powerful intermarket analysis feature, which allows users to look at the key drivers of an underlying asset’s price. This feature quickly highlights the statistically most correlated assets to NXPI, providing traders with valuable insights into the stock’s price movement.

About NXP Semiconductors (NXPI)

NXP Semiconductors N.V. is a leading semiconductor manufacturer with headquarters in Eindhoven, Netherlands and Austin, Texas. The company employs approximately 31,000 people in more than 35 countries and generates $9.41 billion in revenue each year.

Key Takeaways

- NXP Semiconductors (NXPI) shows potential for gains this month.

- Artificial intelligence can help identify opportunities by analyzing stock trends and volatility.

- The VantagePoint software offers a predictive blue line that indicates upward trends, providing traders with valuable insights.

- Common-sense metrics such as annual trading range can help traders understand stock volatility.

- Intermarket analysis provides valuable insights into key drivers of stock price movement.

In conclusion, the use of artificial intelligence in trading can provide valuable insights into potential gains and losses. By analyzing stock trends and volatility, traders can make more informed decisions and identify opportunities for growth.