Weekly Stock Analysis: Signature Bank (SBNY)

Signature Bank (SBNY) has been a volatile stock throughout 2020, experiencing a significant drop due to the COVID-19 lockdown and other factors. The bank’s stock price fluctuated between $68.98 and $148.64 during the year, resulting in an annual trading range of $79.66. Dividing this range by 52 weeks reveals an average weekly trading range of $1.53, which can serve as a guide for traders to define "average" and "normal" price movements.

Common-Sense Metrics

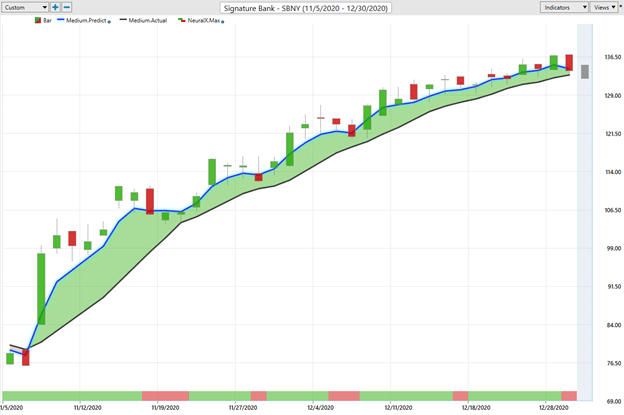

The average weekly trading range is a useful metric for traders, as it helps them understand the stock’s volatility and identify potential areas of support or resistance. In this case, the $1.53 figure can be used as a reference point to determine stop-loss levels or take-profit targets. However, the artificial intelligence has already captured $36.68 per share in just 36 days, which is far beyond what common-sense metrics would consider normal.

Signature Bank’s Performance

Despite its volatile stock price, Signature Bank has seen improving revenues and a robust balance sheet position. The bank’s deposits and loan balances have increased, aided by a rise in interest rates. However, the low-interest rate environment remains a challenge for the company and the entire banking sector. As interest rates remain close to zero, banks struggle to generate revenue through traditional lending activities.

VantagePoint Software Prediction

The VantagePoint Software provides traders with advanced tools to analyze market trends and make informed decisions. The software’s predictive blue line indicates future trend direction, serving as a valuable guide for traders. In the case of Signature Bank (SBNY), the predictive blue line has indicated an uptrend since November 9th. Traders can use this information to identify potential buying opportunities or areas of support.

Artificial Intelligence and Trading

The VantagePoint Software uses artificial intelligence to analyze market data and make predictions about future price movements. The software’s neural index forecasts the short-term anticipated strength or weakness in the market, providing traders with valuable insights. By combining the predictive blue line with the neural index, traders can gain a deeper understanding of market trends and make more informed decisions.

Fine-Tuning Entries and Exits

The VantagePoint Software provides traders with advanced tools to fine-tune their entries and exits. The software’s predictive daily high and low forecast helps traders identify potential areas of support or resistance, enabling them to adjust their trading strategies accordingly. By using the AI-powered predictions, traders can improve their chances of success in the market.

Understanding Signature Bank (SBNY)

Signature Bank is a New York-based full-service commercial bank with 36 private client offices throughout the New York, Connecticut, California, and North Carolina. The bank’s specialty finance subsidiary, Signature Financial LLC, provides equipment finance and leasing services. Signature Securities Group Corporation, a wholly-owned subsidiary, offers investment, brokerage, asset management, and insurance products and services.

About Signature Bank (SBNY)

Signature Bank has been dubbed "NY’s most successful bank" by Crain’s New York Business and ranked as the Best Business Bank, Best Private Bank, and Best Attorney Escrow Services provider by The New York Law Journal in 2018. In 2015, Forbes ranked the bank as No. 1 in its America’s Best & Worst Banks evaluation.

Disclaimer

There is a high degree of risk involved in trading, and it is not prudent or advisable to make trading decisions that are beyond your financial means or involve trading capital that you are not willing and capable of losing. VantagePoint’s marketing campaigns do not constitute trading advice or an endorsement or recommendation by VantagePoint AI or any associated affiliates of any trading methods, programs, systems, or routines.

Conclusion

In conclusion, Signature Bank (SBNY) has been a volatile stock throughout 2020, experiencing significant price fluctuations due to various market factors. While the bank’s revenues and balance sheet position have improved, the low-interest rate environment remains a challenge for the company and the entire banking sector. Traders can use advanced tools like VantagePoint Software to analyze market trends and make informed decisions. By combining common-sense metrics with AI-powered predictions, traders can improve their chances of success in the market.