This is a long and detailed article about trading gold using technical analysis and artificial intelligence (A.I.) tools. The article provides insights into the current market trends, volatility, and risks involved in trading gold. Here’s a summary of the key points:

Market Trends:

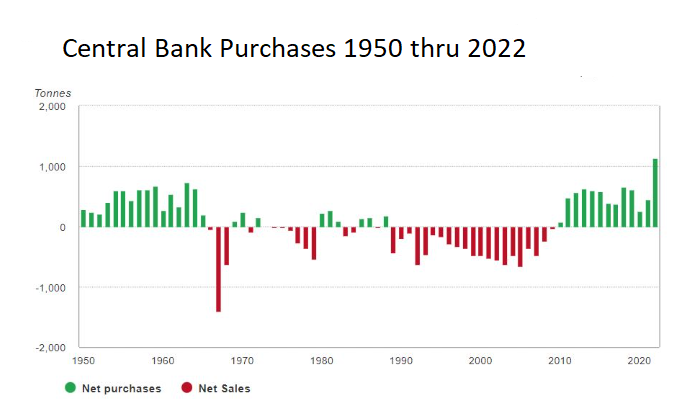

- Central banks’ policies are under scrutiny, and traditional financial institutions are fragile.

- Trust in paper currencies is waning, making gold an attractive alternative investment vehicle.

Technical Analysis:

- The 52-week high for gold is $2030.39, and the 10-year high is $2089.78.

- Breaching these levels would confirm a massive bull market phase in gold.

Artificial Intelligence (A.I.) Tools:

- Vantagepoint A.I. forecast and Neural Network forecast are positive, indicating an upward trend in gold prices.

- The Daily Range Forecast helps traders fine-tune their entries and exits.

Intermarket Analysis:

- 31 key markets drive the price of gold, including interest rates, Gold Prices, and Dollar volatility.

- Understanding these relationships can help traders make better-informed decisions.

Recommendations:

- Follow the A.I. trend analysis outlined in this study.

- Practice good money management on all trades.

- Re-evaluate daily based on new 52-week high and low boundaries, Vantagepoint A.I. Forecast, Neural Network Forecast, and Daily Range Forecast.

Disclaimer:

- Trading involves a high degree of risk.

- It is not prudent or advisable to make trading decisions that are beyond your financial means or involve trading capital that you are not willing and capable of losing.

- Vantagepoint’s marketing campaigns do not constitute trading advice or an endorsement of any trading methods, programs, systems, or routines.

Overall, the article suggests that gold is a promising investment opportunity due to its intrinsic value, universal acceptance, and ability to hold its value even as economies falter. However, traders must be aware of the risks involved and use sound risk management strategies to navigate the market.